Nvidia's upcoming B40 GPU is a big win for Samsung

![Samsung's flag at Samsung Town Headquarters in Seocho, southern Seoul. [YONHAP]](https://img1.daumcdn.net/thumb/R658x0.q70/?fname=https://t1.daumcdn.net/news/202507/22/koreajoongangdaily/20250722161745280tgze.jpg)

[NEWS ANALYSIS]

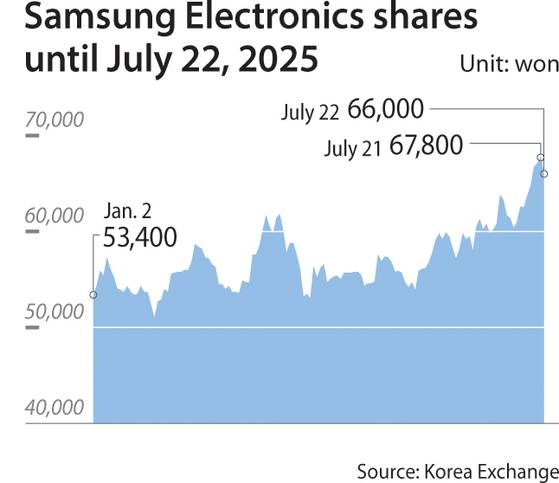

With eased U.S. curbs on Nvidia's chip exports to China, Samsung Electronics is enjoying rare buoyancy on the stock market following tough years that saw it trail behind rival SK hynix.

Nvidia CEO Jensen Huang announced that the U.S. government had granted approval for the company to resume exports of its H20 chips to China at the China International Supply Chain Expo in Beijing on Wednesday, July 16. Huang said export licenses would be issued soon, effectively overturning restrictions imposed in April.

While Nvidia has since informed its Chinese clients that production of its H20 chips will not resume and that it plans to instead focus on depleting remaining inventory, according to U.S. tech outlet The Information, analysts' anticipation is building for Nvidia's rumored upcoming server-class RTX Pro 6000D, nicknamed the B40, which incorporates Samsung’s advanced memory.

![Nvidia CEO Jensen Huang gestures as he speaks on stage during the opening ceremony of the third China International Supply Chain Expo, in Beijing on July 16. [AP/YONHAP]](https://img2.daumcdn.net/thumb/R658x0.q70/?fname=https://t1.daumcdn.net/news/202507/22/koreajoongangdaily/20250722161746948juuz.jpg)

Samsung shares climbed 4.79 percent following Nvidia chief Jensen Huang's public confirmation of the news on July 16 to close at 67,800 won ($48.90) on Monday, marking their highest level this year. The shares retreated 2.65 percent the following day to close at 66,000 won.

Shares have also been gaining traction following the recent acquittal of Samsung Electronics Executive Chairman Lee Jae-yong of accounting fraud charges, a development that resolved a nine-year legal uncertainty surrounding the company’s leadership.

The H20 is the only Nvidia-made AI chip currently eligible for sale in China, specifically designed to comply with U.S. export controls introduced in October 2023. Chinese AI firm DeepSeek deployed the H20 to power its large language models.

The earlier enforcement of restrictions bled losses for Nvidia, which had to “to write off multiple billions of dollars” worth of H20 inventory, Hwang noted. The freeze also hit Samsung; the company acknowledged that “HBM shipments declined to the bottom in the first quarter” due to U.S. export curbs on AI chips on its April conference call.

With Nvidia now potentially regaining access to the Chinese market, attention is turning to the B40 — designed to get around U.S. export regulations.

The B40 uses seventh-generation graphic double data rate (GDDR7) memory, which delivers around 1,100 GB/s bidirectional bandwidth. Samsung, a front-runner in GDDR7 development, is a key supplier of the product to Nvidia, according to multiple reports including U.S. tech outlet Tom's Hardware. Experts expect the Korean chipmaker to reap significant gains once Nvidia’s H20 inventory runs out and B40 shipments ramp up. Huang notably visited Samsung’s booth at GTC 2025 in March where he signed a GDDR7 module.

The eased controls also pave the way for the return of AMD’s China-specific MI300 series, for which Samsung supplies HBM3.

Analysts regard the sudden policy shift as a strategic move in the broader trade standoff between Washington and Beijing.

“China claims it can produce HBM, but in reality, they are unable to manufacture the advanced systems that rely on HBM,” said Kim Yang-paeng, a senior researcher at the Korea Institute for Industrial Economics & Trade. “It’s a structural limitation. Even if China has the technology, it’s difficult to commercialize it in a market where such products cannot be commercially sold.”

Market analysts predict that the reopening of exports will reignite global HBM demand. LS Securities analyst Cha Yong-ho estimates that it could rise by around 3 percent this year, equivalent to 63 million gigabytes, compared to previous forecasts.

Refocused attention for Samsung's profitability falls on its GDDR7 dominance.

“If Samsung becomes the exclusive GDDR7 supplier for Nvidia’s B40, it could significantly contribute to earnings recovery in the fourth quarter,” said Ryu Hyung-keun, an analyst at Daishin Securities. He added that stronger-than-expected sales of AMD chips in China could further bolster Samsung’s HBM competitiveness.

Investment firms have responded by raising target prices for Samsung. Kiwoom Securities increased its target price by 11.25 percent to 89,000 won on Monday. Heungkuk Securities raised its target by 4 percent to 78,000 won, while Yuanta Securities also lifted its target by 4 percent to 77,000 won.

BY LEE JAE-LIM [lee.jaelim@joongang.co.kr]

Copyright © 코리아중앙데일리. 무단전재 및 재배포 금지.

- ‘At-home grooming attempt’: Dog returns to shelter after 7 hours with no hair

- Apple Pay users now able to tap into Korea's transit system with T-Money integration

- Fake clinic caught illegally selling anesthetic to addicts in Gangnam

- Murder by gaslighting? Drowning in 2019 a tale of abuse, infidelity and homicide

- President Lee vows to designate flood-ridden Sancheong County a special disaster zone

- Just 13 percent of foreigners eligible for Korea's consumption coupons

- Evacuated residents spend sleepless night as police defuse bombs found in home of shooting suspect

- Samsung, LG and others turn back time with retro products as they look to the future

- South Korean spy agency halts broadcasts targeting North Korea as Seoul ramps up peace efforts

- Name mix-up causes lighthearted yet awkward moment at Blue Dragon Series Awards