Sampling in a day: How K-beauty ecosystem fast-tracks brand creation

전체 맥락을 이해하기 위해서는 본문 보기를 권장합니다.

"But this studio allows clients to make the samples in a day if they have a clear idea or a concept, because we can adjust things right away."

"I think many indie brands operate with minimum personnel, and there is not a lot of staff specialized in product planning," the head of Chroma Kolmar Studio, Choi Won-jung, said. "Which is why we are here, with Chroma Kolmar Studios and other offerings, so they can visit here and come up with ideas themselves."

이 글자크기로 변경됩니다.

(예시) 가장 빠른 뉴스가 있고 다양한 정보, 쌍방향 소통이 숨쉬는 다음뉴스를 만나보세요. 다음뉴스는 국내외 주요이슈와 실시간 속보, 문화생활 및 다양한 분야의 뉴스를 입체적으로 전달하고 있습니다.

![Chroma Kolmar Studio's Color Director Choi Won-jung explains color themes for the Spring and Summer season of 2025. [PARK SANG-MOON]](https://img3.daumcdn.net/thumb/R658x0.q70/?fname=https://t1.daumcdn.net/news/202507/18/koreajoongangdaily/20250718090055099goxj.jpg)

[NEWS ANALYSIS]

From VT Cosmetics to Tirtir, many of the so-called rising K-beauty brands are built by young founders with little to no experience in the cosmetics industry. In a now familiar script, a wide range of celebrities — K-pop singer Somi or somewhat controversial figures like Cho Min, the daughter of jailed former Justice Minister Cho Kuk — have been venturing into the beauty market and becoming, sometimes, successful CEOs.

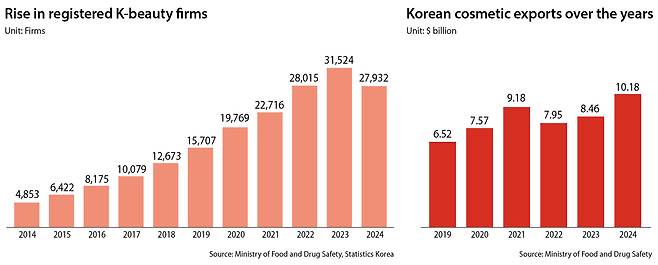

Unlike the car industry or home appliance sectors, where conglomerates like Hyundai or Samsung dominate the market, the K-beauty world works somewhat differently. While there are big-name firms like Amorepacific and LG Household & Health Care still at the top of the food chain, there were a total of 27,932 firms registered as "responsible cosmetic distribution businesses" in Korea — referring to firms who can sell cosmetic products — and more than half, or 66.4 percent of the entire skincare and cosmetic products exported from Korea last year came from small- and medium-sized businesses. Brands like Beauty of Joseon, Dr.Jart+ and Tirtir all fall into the category, with some of their products topping sales on Amazon or Sephora.

The driving force behind the rapid growth of small, indie brands is fueled by a well-established ecosystem that facilitates surprisingly fast product development, even for a small order, and step-by-step marketing consultation.

At the heart of the value chain are original design manufacturers (ODM), which serve as the backbone of the industry, allowing smaller companies to design and market all kinds of beauty products in a speedy, streamlined manner.

Thanks to the evolution and adaptations of ODM firms to streamline the process, brands — or anyone — with vague concepts can release a product in a matter of months.

![Screenshot from singer Somi's cosmetics brand Glyf [SCREEN CAPTURE]](https://img1.daumcdn.net/thumb/R658x0.q70/?fname=https://t1.daumcdn.net/news/202507/18/koreajoongangdaily/20250718090055806kxyk.jpg)

To further expedite the process, Kolmar Korea, the country's leading cosmetics ODM with over 4,000 clients, opened an offline studio where clients can mix colors and choose formulas. The firm also said that it reduced color lead time — the duration between shipping a prototype and finalizing the product with a client — by about a third for even faster results.

"In the past, we mailed product samples, but the process often caused delays due to back-and-forth adjustments related to color and formula differences," said Choi Won-jung, the head of Chroma Kolmar Studio.

"But this studio allows clients to make the samples in a day if they have a clear idea or a concept, because we can adjust things right away."

The entry barrier to ODM has also been lowered, as firms have been reducing the minimum order requirements for cosmetic product orders from the typical 5,000 units down to 3,000 in the case of Cosmax and Kolmar. First-timers can build a K-beauty brand

The term "ODM" in the electronics sector refers more to contract manufacturers who make generic products like cheap music players and portable power banks that are sold under different brands. But in the case of the K-beauty industry, they offer more: On top of research and development, they are also involved in market research to consider the different preferences, regulations around the world. So all you have to do, as a CEO of a K-beauty company, is to talk to the K-beauty ODM to come up with personalized and unique skin care and makeup products without having to do much work.

To streamline the process, Cosmax, another major cosmetic manufacturer, adopted AI to quantify color differences by converting every perceivable shade into data. This allows researchers to predict the color outcome of a new formulation without conducting physical trials.

![Kolmar Korea researchers try out color products [KOLMAR KOREA]](https://img2.daumcdn.net/thumb/R658x0.q70/?fname=https://t1.daumcdn.net/news/202507/18/koreajoongangdaily/20250718090056223zzch.jpg)

The color-mixing process, which traditionally required feedback from the client that was often vague or lacked specificity, has been systematized with AI, allowing the researchers to better mix and predict new colors, according to Cosmax.

The company also operates a dedicated online platform for its customers and prospective clients that allows them to send concept ideas and request development online.

"Clients can use the platform to easily ask us to develop new products based on their idea without having to meet us in person," a spokesperson for Cosmax said.

For novice business owners, Kolmar displays a number of their own color samples or some based on Pantone's Color of the Year at the studio.

While some K-beauty brands often come up with a solid concept and idea for their products, many others, especially smaller firms, approach ODMs like Kolmar Korea with vague ideas, according to Choi.

“I think many indie brands operate with minimum personnel, and there is not a lot of staff specialized in product planning,” the head of Chroma Kolmar Studio, Choi Won-jung, said. “Which is why we are here, with Chroma Kolmar Studios and other offerings, so they can visit here and come up with ideas themselves.”

The firm also offers a Lego-like service, known as the Packaged Product Service, where Kolmar Korea would develop formulae and test them in different packages, even before meeting their customers. The client can then pick different options to create their own combination, which reduces the development and production cycle from nine to 12 months down to three to six months, according to the company.

Cosmecca Korea, another major ODM, focuses on providing market analysis in the development stage.

"Cosmecca’s OGM goes over the existing concept of OEM [original equipment manufacturer] and ODM,” Cosmecca Korea said. The company markets its ODM process as "OGM," with the "G" standing for "good" and "global." “It involves an analysis of retail structures and the regulatory situation of different nations, product planning and designing based on the trends of different markets, and we also provide plans for localization and export.”

The ODM firms also said they won’t provide the same solution to different customers, which reduces the possibility of copycat products. What they can do, however, is produce new products with similar but slightly varied ingredients and formulas. Help is at hand for exporting products

![Amazon's new seller Accelerator program [SCREEN CAPTURE]](https://img3.daumcdn.net/thumb/R658x0.q70/?fname=https://t1.daumcdn.net/news/202507/18/koreajoongangdaily/20250718090056682ufql.jpg)

While making a new K-beauty product can be easy — if you have a good enough idea — selling them to the global market is another story. But firms like Olive Young, Amazon and K-beauty accelerator firm Most are here to help.

It famously took Amorepacific a decade to have its lineup of cosmetic products on the shelves of Sephora, and the store, even to this day, mostly sells products from bigger K-beauty firms, such as Aestrua, Laniege, Hanyul and Estee Lauder's Dr Jart+.

Smaller Korean brands, therefore, first turn to Amazon and online platforms that specialize in K-beauty products, like YesStyle and StyleKorean. Beauty of Joseon, Cosrx, Medicube and VT Cosmetics all currently have skincare-related products as top sellers on Amazon, with Beauty of Joseon's eye serum selling over 50,000 units monthly. Amazon, in return, also began its Amazon New Seller Accelerator program that specializes in inviting growing K-beauty businesses to its platform.

Under Amazon's ongoing 2025 accelerator program, 20 firms in the K-beauty categories, from skincare to makeup and beauty tech firms, were chosen.

Amazon said that beauty product sales for Korean retailers rose 170 percent on year in 2024 on Amazon in the United States.

"Amazon Accelerator is not just a program that supports product launch," the head of Amazon Global Selling Korea said. "It's a journey between K-beauty brands that seek global growth and Amazon."

Olive Young, the prominent offline K-beauty retailer in Korea, is similarly expanding its global online mall, which experienced a 70 percent surge in revenue in the first half of 2025 compared to the same period last year.

The retailer, teaming up with the Ministry of SMEs and Startups, also began its K-Super Rookie With Young program that aims to help indie brands sell in the global market. Out of the 232 brands that signed up for the program, Olive Young chose 25 brands to support in global expansion, including a dedicated in-store section in Olive Young branches in touristy areas.

ODM also operates factories outside Korea. While overseas factories were originally designed for international clients, they also act as a production hub for Korean firms. Kolmar, in particular, completed its second factory in Pennsylvania, United States, on Thursday to act as a production hub for manufacturing 300 million units of beauty products per year. Making K-beauty products in the United States also bypasses potential tariffs.

It's not just big retailers helping export momentum, as K-beauty-focused accelerator and exporting firm Most also played a role in selling Korean products to brick-and-mortar stores in the United States, most notably to Costco. The company managed to distribute Biodance’s collagen masks, Cosrx’s snail essences as well as products from almost 30 Korean brands to Costco stores in North America.

![Most CEO Daniella Jung [MOST]](https://img1.daumcdn.net/thumb/R658x0.q70/?fname=https://t1.daumcdn.net/news/202507/18/koreajoongangdaily/20250718090057032xsij.jpg)

Most said it has managed to successfully convince U.S. retailers to sell Korean beauty products in their stores, but founder and CEO Daniella Jung said it’s more important to keep the products on the shelves.

“We can convince retailers to buy the Korean products, but it’s up to the consumers to purchase them regularly so the products are ordered regularly,” Jung said. “If not, the brands will be kicked out, and that’s worse than not entering in the first place.”

Jung said that while Most can help guide small brands in the U.S. market, it’s eventually up to them to stay attractive against stiff competition.

You can’t just expect to sell your products in the United States when most of them are designed for Korea,” Jung said.

A lack of color range in makeup lineups and differences in trends can throttle the sales of Korean beauty brands, according to the CEO.

“If you only have the color range for Asians and are not inclusive of different people, it's better not to even try to sell it in the United States,” she said.

Correction, July 18, 2025: Revised the minimum order quantity for Kolmar as noted by the company.

BY CHO YONG-JUN,PARK EUN-JEE [cho.yongjun1@joongang.co.kr]

Copyright © 코리아중앙데일리. 무단전재 및 재배포 금지.

- Young Koreans are 'taking breaks' from their jobs — and their parents aren't sure when they can retire

- 'Straight out of a drama': Valedictorian's mother caught breaking into school to steal exams

- Torrential rains devastate Korea — in pictures

- Sampling in a day: How K-beauty ecosystem fast-tracks brand creation

- Korea braces for heavy downpours followed by intense heat wave over weekend

- 3 unresponsive, others injured in apartment parking lot fire in Gwangmyeong

- Record-breaking rains cause fatalities as road, train closures toss country into chaos

- Half of Korea's law school graduates fail the bar exam. Is there a solution?

- Stray Kids collaborates with Tottenham Hotspur on new away kit

- Why Astro's Yoon San-ha clashed with Cha Eun-woo on new album: 'I gained more confidence'