Unfazed by Musk-Trump row, Korean investors boost leveraged Tesla bets

전체 맥락을 이해하기 위해서는 본문 보기를 권장합니다.

"It really seems to be largely driven by psychology," said Park Seung-jin, a Seoul-based senior analyst at Hana Securities, regarding Korean investors' enthusiastic buying of Tesla. "Musk's ongoing presentation of innovative and visionary stories — creating things that never existed before — is drawing investors in."

"Overcoming the challenges ultimately comes down to technological capability, and I believe that combining full self-driving with affordable models that cost below $30,000 can push a recovery in performance."

이 글자크기로 변경됩니다.

(예시) 가장 빠른 뉴스가 있고 다양한 정보, 쌍방향 소통이 숨쉬는 다음뉴스를 만나보세요. 다음뉴스는 국내외 주요이슈와 실시간 속보, 문화생활 및 다양한 분야의 뉴스를 입체적으로 전달하고 있습니다.

![Tesla CEO Elon Musk gestures on stage as he prepares to speak inside the Capital One Arena on the inauguration day of Donald Trump's second presidential term, in Washington on Jan. 20. [YONHAP/ REUTERS]](https://img1.daumcdn.net/thumb/R658x0.q70/?fname=https://t1.daumcdn.net/news/202507/10/koreajoongangdaily/20250710183310912nqre.jpg)

[BEHIND THE NUMBERS]

Elon Musk’s feud with U.S. President Donald Trump and his announcement of the launch of a political party have sent Tesla shares into a tailspin, but some Korean investors are doubling down on the EV giant.

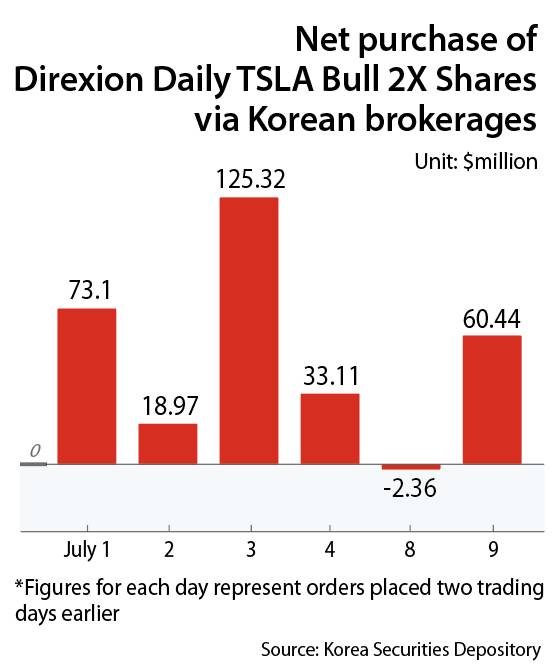

Net purchases of Direxion Daily Tsla Bull 2X Shares (TSLL), a leveraged exchange-traded fund (ETF) listed in the United States seeking a twofold daily return on Tesla, totaled $58 million from only Monday through Wednesday, according to depository data.

Trailing distantly was Direxion Daily Semiconductor Bull 3X Shares, a leveraged ETF seeking a threefold daily return on a semiconductor sector index, with net purchases amounting to less than half that of TSLL.

Figures for each day represent orders placed two trading days earlier.

TSLL shed 13 percent on Monday after the billionaire's announcement the previous week that he would form the "America Party" after a fallout with Trump, while Tesla lost almost 7 percent.

Korean investors on the day placed orders for $136 million worth of TSLL, and $146.9 million of Tesla.

Despite the volatility, Tesla and its leveraged stock remain popular among yield-hungry investors able to tolerate high risk for high returns.

"Due to Musk’s unpredictable behavior, Tesla should be “best approached as a short-term trading stock,” said Lee Yong-wook, a Seoul-based office worker, who held TSLL for a quarter through July. “I think Musk’s unpredictability may actually present an opportunity, making Tesla an exceptionally appealing pick for short-term gainers."

Musk recognized the passion Koreans have for Tesla.

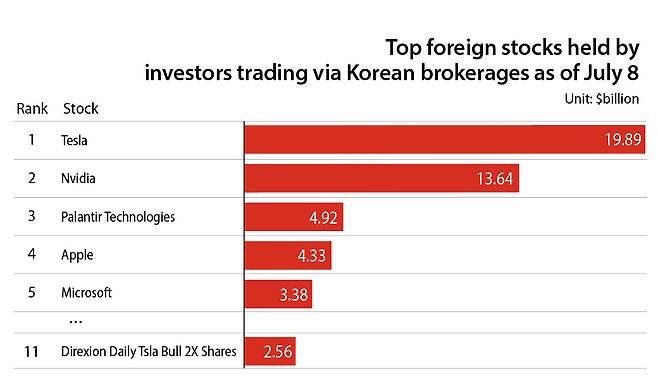

In a social media post last July, Musk praised Koreans as “smart people” and noted that Tesla is the most widely held stock among Korean investors.

That holds true even today.

Korean investors held $19.89 billion worth of Tesla shares — the most among all foreign equities — as of Tuesday, roughly accounting for 2 percent of the EV carmaker's market value.

That amount of holding is 45 percent more than that of far second Nvidia, which recently became the world’s first company to reach a market value of $4 trillion.

“It really seems to be largely driven by psychology,” said Park Seung-jin, a Seoul-based senior analyst at Hana Securities, regarding Korean investors’ enthusiastic buying of Tesla. “Musk’s ongoing presentation of innovative and visionary stories — creating things that never existed before — is drawing investors in.”

Park said that he found the structure and strategy of Musk’s brain-technology startup Neuralink, known for its brain implants, as well as Starlink, the satellite internet service operated by SpaceX, innovative.

Some investors also hold that belief.

"I tell myself never to look back, but for some reason, I keep coming back to Tesla," said Lee Jong-won, a 33-year-old office worker in Seoul.

Since Lee started investing in U.S. stocks in 2020, the majority of the losses he incurred were from the EV maker.

Most recently, he lost 10 percent of his Tesla investment. While holding it for a little more than a week through early July, he was restless, unable to sleep at night, watching news about Musk and his companies, including SpaceX, which launches rockets and spacecraft.

"Despite the recent stock price fall, I still believe in Musk's personal capability that may one day lead him to dominate entire industries, ranging from not just autonomous EVs but also humanoid robotics, defense and space."

![A Tesla robotaxi drives on the street along South Congress Avenue in Austin on June 22. [YONHAP/ REUTERS ]](https://img1.daumcdn.net/thumb/R658x0.q70/?fname=https://t1.daumcdn.net/news/202507/10/koreajoongangdaily/20250710183314809dfqe.jpg)

Despite Musk’s milestones, his brand faces headwinds, including his clash with Trump.

Musk’s criticism of the president's One Big Beautiful Bill Act, which pulls the plug on federal tax incentives for EVs, became the catalyst for their major fallout.

Trump signed the bill into law on July 4.

Tesla’s recent earnings have also been weak.

Tesla missed Wall Street estimates, reporting a 20 percent plunge in automotive revenue in the first quarter from a year earlier.

There is little optimism for its second quarter earnings, too, as the company posted global vehicle sales down 13.5 percent in the second quarter compared to a year ago, according to FactSet.

The carmaker is set to announce its full financial results for the second quarter on July 23.

“With the expiration of the EV tax credits under the Inflation Reduction Act ending on September 30, there is a high possibility of contraction in the EV market,” said Esther Yim, a senior analyst at Samsung Securities.

“Overcoming the challenges ultimately comes down to technological capability, and I believe that combining full self-driving with affordable models that cost below $30,000 can push a recovery in performance."

Tesla has been talking about an affordable EV, potentially named the Model 2, priced around $30,000.

Such a strategy could reignite investor confidence, especially among retail investors who continue to bet on Musk’s bold vision.

“Never underestimate the man who overestimates himself,” said the loss-lamenting Lee, quoting Charlie Munger, the late vice chairman of Berkshire Hathaway, about Musk.

“I believe in Musk, and honestly, I think I’ll buy Tesla again in the future when the market turns bullish."

BY JIN MIN-JI [jin.minji@joongang.co.kr]

Copyright © 코리아중앙데일리. 무단전재 및 재배포 금지.

- Woman hit by falling teen dies a day after 11-year-old daughter in same incident

- North Korean defector sues Kim Jong-un in historic first

- 삼성, 평택 신규 공장 건설 박차...HBM4로 반격 시도

- Tuna travesty as massive bluefin haul off Korea's east coast dumped due to fishing quotas

- U.S. calls to 'modernize' alliance with South Korea may put Seoul-Washington ties at a crossroads

- Too hot for school: Summer break may come early

- North Koreans no longer tuning in to South Korean radio channels

- 'Unbearably hot': Ex-President Yoon to endure summer heat in cell alone as he awaits trial

- Court issues warrant returning ex-President Yoon to custody over martial law bid

- This golfer is joining the PGA tour — after playing only 30 rounds of real golf