Inside Hyundai’s calculated silence on Boston Dynamics

전체 맥락을 이해하기 위해서는 본문 보기를 권장합니다.

"While Boston Dynamics is likely to remain in the red due to large-scale R&D [research and development] investment, its enterprise value will likely rise as the Atlas humanoid continues to mature and nears commercial deployment."

"While Hyundai has made no formal announcement regarding the listing, market participants have long viewed the IPO of the robotics firm as a near-certainty, precisely because of its potential role in financing the succession process," Lee said. "Growing anticipation suggests that the listing timeline may arrive sooner than initially expected."

이 글자크기로 변경됩니다.

(예시) 가장 빠른 뉴스가 있고 다양한 정보, 쌍방향 소통이 숨쉬는 다음뉴스를 만나보세요. 다음뉴스는 국내외 주요이슈와 실시간 속보, 문화생활 및 다양한 분야의 뉴스를 입체적으로 전달하고 있습니다.

![Hyundai Motor Group Executive Chair Euisun Chung walks with Boston Dynamics' Spot robot dog in Las Vegas ahead of CES 2022. [HYUNDAI MOTOR]](https://img3.daumcdn.net/thumb/R658x0.q70/?fname=https://t1.daumcdn.net/news/202507/09/koreajoongangdaily/20250709123544220vexo.jpg)

[NEWS ANALYSIS]

Hyundai Motor Group is now on the hook for full ownership of Boston Dynamics, a Massachusetts-based robotics company best known for its Spot robot dog. A clause in its agreement with SoftBank allowed the latter to sell its remaining stake if an initial public offering (IPO) did not take place. With the deadline for the listing set for the end of June, industry insiders predict that the Korean automobile giant will move to buy the SoftBank-owned 12.4 percent stake, estimated to be worth roughly 300 billion won ($220 million) for now.

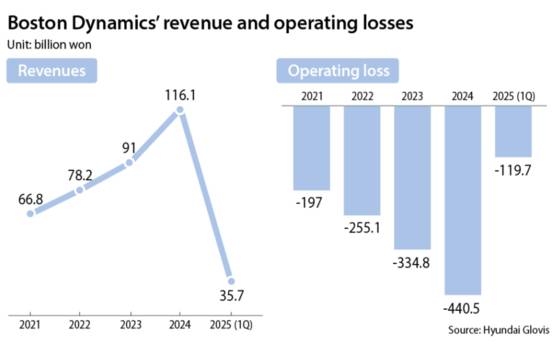

On paper, the bet on Boston Dynamics has yet to pay off. The robot unit reported 440.5 billion won in operating loss last year. But Boston Dynamics, founded as a spinoff of MIT, could be an asset in its vision centered on robotics, while autonomous driving and electric vehicles, the areas once considered a growth engine, hardly gain momentum.

If the U.S. subsidiary goes public, the proceeds could serve as one of the most effective and timely means to raise capital for boosting Hyundai Motor Group Executive Chair Euisun Chung's ownership of the group.

Waiting for the right valuation While market speculation continues to swirl around a possible listing on the Nasdaq or Korean stock exchange, Hyundai remains tight-lipped and appears to be biding its time, likely in pursuit of a valuation that reflects the robotics firm's full strategic potential.

Boston Dynamics remains mired in losses, with its losses incurred at 255.1 billion won in 2022, which grew to 334.8 billion won in 2023. In 2024, the loss even grew to 440.5 billion won, according to an electronic disclosure by Hyundai Glovis.

Hyundai acquired some 80 percent stake of Boston Dynamics from SoftBank in June 2021 for $880 million, with Chung contributing approximately 240 billion won of his personal stake, 20 percent. At the time of acquisition, Hyundai pledged to pursue an IPO within four years — which ended in June 2025.

Then three rounds of capital increases have raised Hyundai’s ownership to some 65.7 percent, while Chung’s stake has grown to 21.9 percent. However, with the agreed IPO timeline now expired, SoftBank may exercise its put option to off-load its remaining 12.4 percent stake to Hyundai.

![Atlas, Boston Dynamics’ bipedal humanoid robot [BOSTON DYNAMICS]](https://img1.daumcdn.net/thumb/R658x0.q70/?fname=https://t1.daumcdn.net/news/202507/09/koreajoongangdaily/20250709123544835nvnw.jpg)

“The current valuation of Boston Dynamics is estimated between 4 trillion won and 10 trillion won, but in a highly optimistic scenario, it could exceed 20 trillion won by 2032,” said researcher Song Sun-jae from Hana Securities.

“While Boston Dynamics is likely to remain in the red due to large-scale R&D [research and development] investment, its enterprise value will likely rise as the Atlas humanoid continues to mature and nears commercial deployment.”

Lee Seung-jo, executive vice president of Hyundai’s planning and finance division, hinted that “the opportunity for a Boston Dynamics IPO remains open,” and that it “will proceed if necessary,” without giving any details, during a conference call in February.

![Atlas demonstrates ″part sequencing,″ its ability to autonomously sort, retrieve and place parts. [BOSTON DYNAMICS]](https://img2.daumcdn.net/thumb/R658x0.q70/?fname=https://t1.daumcdn.net/news/202507/09/koreajoongangdaily/20250709123545373vkcf.jpg)

A hidden linchpin in Hyundai's succession Boston Dynamics may soon play a far more strategic role — as a possible financial cornerstone in Chung’s succession plan.

As the affiliate in which Chung holds his largest personal stake, a successful IPO would allow Chung to monetize his approximately 22 percent stake, potentially unlocking billions in capital needed to tighten control of Hyundai’s complex governance structure.

Hyundai Motor Group is the only major Korean conglomerate still operating under a circular shareholding system. Hyundai Mobis is the largest shareholder of Hyundai Motor, which, in turn, controls Kia, while Kia circles back as a key shareholder of Hyundai Mobis. At the top of this interlinked hierarchy stands Hyundai Mobis, whose ownership is crucial to the group's power dynamics.

To secure effective control, Chung must significantly increase his stake in Hyundai Mobis, of which he currently owns 0.3 percent. His father, Honorary Chairman Chung Mong-koo, owns a 7.29 percent stake, expected to be passed down to the younger Chung.

![Stretch box-moving robot built for warehouse and logistics automation [BOSTON DYNAMICS]](https://img1.daumcdn.net/thumb/R658x0.q70/?fname=https://t1.daumcdn.net/news/202507/09/koreajoongangdaily/20250709123545762kgag.jpg)

Even if the inheritance, valued at around 2 trillion won, goes through, Euisun Chung would still face a potential tax burden of up to 1.2 trillion won. Analysts believe he may need to acquire at least an additional 10 percent stake in Hyundai Mobis, requiring an estimated 5 trillion won in supplementary funds.

This is where Boston Dynamics comes into play. Should its public offering succeed, Euisun Chung could divest a portion — or even the entirety — of his stake without endangering group control. HMG Global, Hyundai’s overseas investment venture jointly owned by Hyundai, Kia and Hyundai Mobis, already holds a 54.7 percent stake in the robotics firm, ensuring that governance remains within the group even if Chung exits as a shareholder.

“In practical terms, for Chung, one of the few viable avenues for raising such a significant sum is the sale of roughly 20 percent of his personal stake in Boston Dynamics following its IPO,” said analyst Lee Sang-su from iM Securities.

“While Hyundai has made no formal announcement regarding the listing, market participants have long viewed the IPO of the robotics firm as a near-certainty, precisely because of its potential role in financing the succession process,” Lee said. “Growing anticipation suggests that the listing timeline may arrive sooner than initially expected.”

Market watchers expect the IPO to take place around 2027. Hyundai also announced that it plans to deploy 30,000 units of its robotics lineup.

![Atlas, Boston Dynamics’ bipedal humanoid robot [BOSTON DYNAMICS]](https://img4.daumcdn.net/thumb/R658x0.q70/?fname=https://t1.daumcdn.net/news/202507/09/koreajoongangdaily/20250709123546196ipzi.jpg)

Atlas vs. China: Can Hyundai compete? Hyundai’s continued backing of the unprofitable Boston Dynamics underscores a deeper strategic calculus: In the escalating technological rivalry between the United States and China over humanoid robotics, Boston Dynamics remains one of the few Korean company-owned companies with the engineering sophistication to stand toe-to-toe with formidable challengers like Tesla’s Optimus and China’s Unitree Robotics’ G1.

Boston Dynamics is currently developing Atlas, its first bipedal humanoid robot, and is set to begin proof-of-concept deployment this October at Hyundai’s EV plant in Georgia.

As a humanoid robot capable of autonomous decision-making and movement, Atlas is able to rise from the floor by twisting its joints and walking while rotating its torso 360 degrees, and even working like a human in a factory setting, transporting engine cover parts to a storage bin and recognizing various components to insert them into their designated slots.

Atlas’s market launch is currently expected for 2028.

“Boston Dynamics has a depth of expertise in robot control and robot engineering that is lacking in other companies; it is extremely challenging to raise the level of the robot to being practically useful,” Nathan Lepora, robotics professor at the University of Bristol, told the Korea JoongAng Daily.

“Atlas is an advanced intelligent robot, but it should invest more in dexterous robot manipulators, or robot hands, and their control, particularly in the use of tactile sensing to enable autonomous manipulation.”

![Spot robot dog [BOSTON DYNAMICS]](https://img2.daumcdn.net/thumb/R658x0.q70/?fname=https://t1.daumcdn.net/news/202507/09/koreajoongangdaily/20250709123546498jhvr.jpg)

Boston Dynamics was named in Morgan Stanley’s recently released The Humanoid 100 report, which identified 66 companies worldwide that unveiled humanoid robots between 2022 and February 2025.

Strikingly, 40 of them, or 61 percent of the total, were Chinese companies. Sixteen were based in the United States or Canada, and only one Korean company made the list.

Tesla claimed in an X post in June of last year that it had already deployed two Optimus bots in its factory, and owner Elon Musk set a very rough target of manufacturing 10,000 units by the end of this year, claiming they would be able to "be able to play the piano and be able to thread a needle" in the company's earnings call for the full year and fourth quarter of 2024.

U.S.-based Nvidia CEO Jensen Huang took the stage at CES 2025 alongside 14 humanoid robots developed by leading global partners, six of which had been produced in China. Korean products were absent from the lineup, while Boston Dynamics’ Atlas was among the featured models.

Chinese firms own some 5,590 international patents related to humanoid technology, accounting for 55 percent of the globe’s total, far surpassing the United States’ 1,442, Japan’s 1,095 and Korea’s 322.

BY SARAH CHEA [chea.sarah@joongang.co.kr]

Copyright © 코리아중앙데일리. 무단전재 및 재배포 금지.

- Woman hit by falling teen dies a day after 11-year-old daughter in same incident

- Tuna travesty as massive bluefin haul off Korea's east coast dumped due to fishing quotas

- 'I did everything I could': Actor Lee Jung-jae bids farewell to iconic 'Squid Game' character in final season

- A single watermelon now costs more than dining out

- Seoul gov't program gives international students the lowdown on life in the city

- Trump tariffs pushed to Aug. 1, granting Korea crucial negotiating window

- Man who allegedly threw boiling cooking oil on neighbor apprehended

- Lawyer speculates on legal terrain actor Lee Si-young may face over IVF without ex's input

- Trump says Korea should pay for its own defense

- Seoul hits 37.1 degrees in hottest early July in 117 years