Korean banks' net debt offering hit record high in Sept to fan market yields

![[Photo by Yonhap]](https://img4.daumcdn.net/thumb/R658x0.q70/?fname=https://t1.daumcdn.net/news/202210/04/mk/20221004135402533bfgd.jpg)

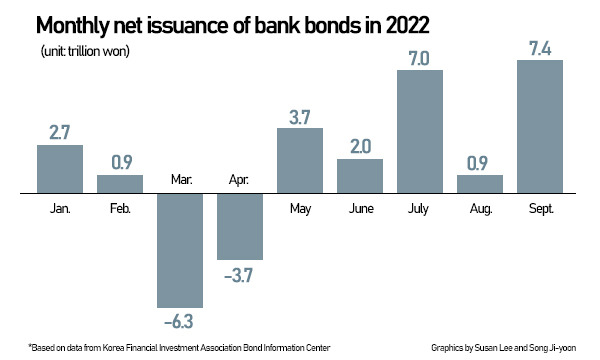

According to Korea Financial Investment Association (KOFIA), net debt issuance from lenders reached 7.46 trillion won last month. Net issues neared 25.88 trillion won in September.

The Industrial Bank of Korea (IBK) and Korea Development Bank (KDB) - which mainly lend to corporations - each issued 6 trillion to 7 trillion won worth of bonds in September. Commercial banks offered 1 trillion to 2 trillion won worth.

Banks lending to companies average at 4 percent range, whereas the yields for unsecured three-year AA- corporate bonds average above 5 percent and BBB- bonds above 11 percent, turning companies to banks for funding.

Corporate loan balance at the country’s top 5 banks – KB Kookmin, Shinhan, Hana, Woori and NH Nonghyup, grew by 4.89 trillion won to 692.33 trillion won as of Sept. 29.

The surge in banks’ debt sales generally leads to a rise in overall bond yields. According to the BIS, the annual yield on five-year bank bonds rose 0.556 percent in less than a month to 4.851 percent at the end of September from 4.295 percent at the end of August.

The rises in market yields can add to the rising mortgage loans that are mostly lent out in floating rates.

At the end of last month, the five major banks’ annual mixed mortgage rates ranged from 4.73 to 7.141 percent. The three lenders with mixed mortgage rates that exceeded 7 percent in the top end were Hana Bank, Woori Bank, and Nonghyup Bank.

Another concerning factor is that a whopping 20.1206 trillion won worth of bonds with high yields are set to mature in October. The yields on bank bonds are expected to continue to surge this month.

“The recent spike in the yields on bonds that mature in less than one year will lead to further hikes in lending rates for households and companies,” said Lee Young-sun, the head of the Bank of Korea's financial market research team.

[ⓒ Maeil Business Newspaper & mk.co.kr, All rights reserved]

Copyright © 매일경제 & mk.co.kr. 무단 전재, 재배포 및 AI학습 이용 금지

- KB Kookmin Bank readies another rescue fund for Indonesian unit KB Bukopin - Pulse by Maeil Business News Korea

- Toolgen gains upper hand in CRISPR patent dispute over US schools - Pulse by Maeil Business News Korea

- Lotte Duty Free readying to open first inner city duty-free store in Vietnam in Da Nang - Pulse by Maeil Business News Korea

- Korea’s top 10 groups lose $106 bn in market cap since mid-Aug on Kospi free fall - Pulse by Maeil Business News Korea

- LG Electronics to release 136-inch micro LED TV worth $69,720 at home - Pulse by Maeil Business News Korea

- 강경준, 상간남 피소…사랑꾼 이미지 타격 [MK픽] - 스타투데이

- AI가 실시간으로 가격도 바꾼다…아마존·우버 성공 뒤엔 ‘다이내믹 프라이싱’- 매경ECONOMY

- 서예지, 12월 29일 데뷔 11년 만에 첫 단독 팬미팅 개최 [공식] - MK스포츠

- 이찬원, 이태원 참사에 "노래 못해요" 했다가 봉변 당했다 - 스타투데이

- 양희은·양희경 자매, 오늘(4일) 모친상 - 스타투데이