Share of Japanese imports in IT components falls, but Korea's reliance on China rises

이 글자크기로 변경됩니다.

(예시) 가장 빠른 뉴스가 있고 다양한 정보, 쌍방향 소통이 숨쉬는 다음뉴스를 만나보세요. 다음뉴스는 국내외 주요이슈와 실시간 속보, 문화생활 및 다양한 분야의 뉴스를 입체적으로 전달하고 있습니다.

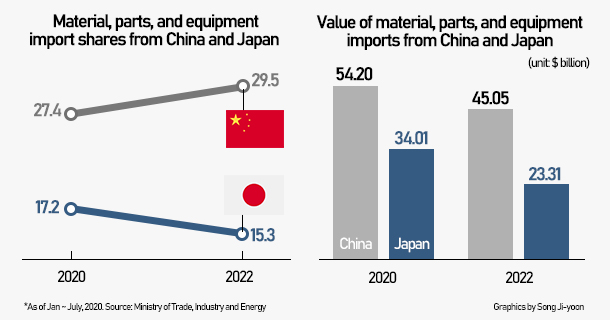

According to the Ministry of Trade, Industry, and Energy’s data on Monday, the share of imports of materials, parts, and equipment from Japan has gradually come down from 17.2 percent in 2020 to 15.8 percent in 2021 and 15.3 percent this year.

But the value has increased. Imports in the area of materials, parts, and equipment from Japan amounted to $23.3 billion in the first seven months of the year, following full-year value of $39.3 billion in 2021 and $34.6 billion in 2020.

Trade deficit with Japan as result has widened.

It has incurred a deficit of $14.5 billion in trade with Japan as of July this year after a deficit of $24.4 billion last year and $21.3 billion in 2020.

The Japanese government hit South Korea with various sanctions and restricted exports of semiconductor and display materials after Korea’s Supreme Court ordered Japanese firms to compensate victims of wartime forced labor.

Korea’s imports from China in the sector has gone up sharply.

Imports of materials, parts, and equipment from China have surged from $54.2 billion in 2020 to $71 billion in 2021. During the first seven months of this year, imports have already recorded $45.1 billion and are expected to reach the $77 billion mark by the end of the year.

The share of Chinese imports in the materials, parts, and equipment sector has reached nearly 30 percent, recording 29.5 percent in July this year.

Korea’s surplus in the area in trade with China has fallen to $35.5 billion in 2021 from $36.3 billion in 2020. This year’s surplus is expected to stop at $23 billion as the black reached $13.5 billion as of July.

The increase in imports of materials and parts for secondary batteries and the operation of Samsung Electronics plants in China increased reliance on imports from China,” said Kim Jung-sik, an emeritus professor at Yonsei University’s School of Economics.

Meanwhile, the trade in the materials, parts, and equipment sector logged a surplus of $62.4 billion with exports coming to $215.1 billion and imports $152.6 billion during the January-July period this year despite widened deficit in the overall trade balance.

[ⓒ Maeil Business Newspaper & mk.co.kr, All rights reserved]

Copyright © 매일경제 & mk.co.kr. 무단 전재, 재배포 및 AI학습 이용 금지

- Hanwha Solutions stock flies on solar panel boon from U.S. Inflation Reduction Act - Pulse by Maeil Business News Korea

- LG Group fields 50-something CTOs to spearhead innovation and tech advance - Pulse by Maeil Business News Korea

- Korea’s industrial stock of LNG relatively stable via preemptive move by companies - Pulse by Maeil Business News Korea

- Tesla quickly losing grounds in Korea with zero sale in July - Pulse by Maeil Business News Korea

- Hyundai Motor Group No. 3 car seller in global rank as of H1 - Pulse by Maeil Business News Korea

- 강경준, 상간남 피소…사랑꾼 이미지 타격 [MK픽] - 스타투데이

- AI가 실시간으로 가격도 바꾼다…아마존·우버 성공 뒤엔 ‘다이내믹 프라이싱’

- 서예지, 12월 29일 데뷔 11년 만에 첫 단독 팬미팅 개최 [공식] - MK스포츠

- 이찬원, 이태원 참사에 "노래 못해요" 했다가 봉변 당했다 - 스타투데이

- 양희은·양희경 자매, 오늘(4일) 모친상 - 스타투데이