KEPCO loss at $5 bn Q2, $11 bn H1 and likely see equally big loss H2

![[Photo by MK DB]](https://img4.daumcdn.net/thumb/R658x0.q70/?fname=https://t1.daumcdn.net/news/202208/12/mk/20220812143901501khmc.jpg)

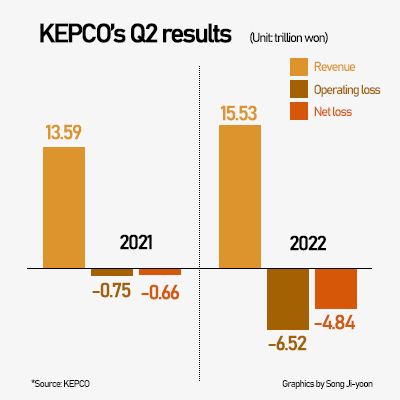

KEPCO disclosed Friday its consolidated operating loss came to 6.5 trillion in the second quarter ended June, placing the cumulative six-month loss at 14.3 trillion won.

Consensus had placed the second-quarter loss at 5.4 trillion won and for the first half at 13 trillion won.

Amid limited options and little easing in fuel import prices, the state utility giant is expected to finished the year with losses of around 30 trillion won

Shares of KEPCO were 0.9 percent higher at 22,000 won Friday afternoon.

Net loss reached 4.8 trillion won for the second quarter and 10.8 trillion for the first half.

Revenue fell 5.7 percent on quarter to 15.5 trillion won in the second quarter. It gained 11.5 percent on year to 32 trillion won for the first half.

The system marginal price (SMP), which refers to the price that KEPCO pays to electricity producers, averaged at 169.3 won per kilowatt hour (kWh) in the first half, surging 117 percent on year. The purchasing cost for LNG jumped 132.7 percent to 1,344,000 won per ton and coal 221.7 percent to $319 per ton.

KEPCO’s average selling price in the first half stopped at 110.4 won. It had been buying power at 169.3 won and selling at 110.4 as fuel rate gains have been capped in light of inflation.

KEPCO is expected to suffer even greater losses in the third quarter as purchase prices have gone even higher.

SMP in July stood at 151.85 won per kWh, up 17.1 percent from June. It reached 200.20 won on August 1, up from 139.88 won at the end of July, and 206.39 won on August 4. Gas prices have soared as Russia has reduced supply.

KEPCO’s fuel cost adjustment fee applied for power costs in the third quarter in contrast rose only 5 won per kWh. Electricity bills consist of basic fuel cost, climate environment fee, and fuel cost adjustment fee.

The Ministry of Trade, Industry and Energy in May has given administrative notice on placing a temporary cap on the rise in SMP in the advent of unusual surge, but the move has been stalled due to protest from private suppliers.

Private electricity producers contest they were being sacrificed to make up for KEPCO losses.

The option of further hiking electricity rate also may not be easy, with inflation already flying above 6 percent.

[ⓒ Maeil Business Newspaper & mk.co.kr, All rights reserved]

Copyright © 매일경제 & mk.co.kr. 무단 전재, 재배포 및 AI학습 이용 금지

- Samsung and Lotte tycoons reinstated from Yoon’s first presidential pardon - Pulse by Maeil Business News Korea

- Korea’s import price index falls for first time in 3 mos, upside for trade deficit, inflation - Pulse by Maeil Business News K

- Samsung Biologics snatches record deal with AZ to overachieve last year’s orders - Pulse by Maeil Business News Korea

- K-bio names draw limelight on progress in precision therapies in lung cancer forum - Pulse by Maeil Business News Korea

- SK bioscience shares extend gains on expectations for Bill Gates meeting - Pulse by Maeil Business News Korea

- 강경준, 상간남 피소…사랑꾼 이미지 타격 [MK픽] - 스타투데이

- AI가 실시간으로 가격도 바꾼다…아마존·우버 성공 뒤엔 ‘다이내믹 프라이싱’- 매경ECONOMY

- 서예지, 12월 29일 데뷔 11년 만에 첫 단독 팬미팅 개최 [공식] - MK스포츠

- 이찬원, 이태원 참사에 "노래 못해요" 했다가 봉변 당했다 - 스타투데이

- 양희은·양희경 자매, 오늘(4일) 모친상 - 스타투데이