Despite heavy selling, Korean pensions lose money from H1 stock investment

Korean public fund operators, including the country’s largest institutional investor National Pension Service (NPS), have net bought 432.9 billion won ($336.8 million) in the Kospi market and 116.8 billion won in the Kosdaq market so far this year, according to stock market operator Korea Exchange on Monday.

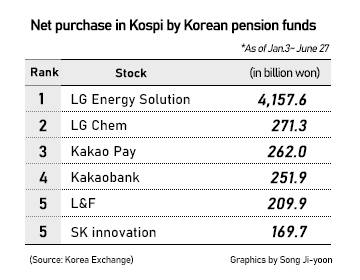

Their top buy for the first half of this year has been LG Energy Solution. They purchased 4.2 trillion won worth in the stock at 465,945 won apiece on average. Shares as of Tuesday midday were at 408,500 won.

Shares of LG Chem, the second most purchased Korean stock by the local pension funds, lost 5 percent over the same period. Their third and fourth favorites Kakao Pay and Kakao Bank are doing even worse, logging negative returns of 45 percent and 19 percent, respectively.

The institutional investors are also seeing negative returns from SK Innovation (-12 percent), Pan Ocean (-10 percent), Amorepacific (-19 percent), F&F (-32 percent), and SD Biosensor (-23 percent).

They fared better in secondary battery and shipbuilding stock investments.

Pension funds operators have purchased shares of cathode materials supplier L&F at average 21,890 won apiece to generate about 13 percent returns.

Shipbuilders have been a satisfaction.

Pension funds bought Hyundai Mipo Dockyard at average 80,782 won apiece and Hyundai Heavy Industries at 117,868 won. Their stock prices were trading at 87,000 won and 137,500 won each on Tuesday morning.

Others that have delivered profits were OCI, Korea Aerospace Industries, and Korea Electric Power Corp.

Local pension funds are expected to remain wary of the local market.

NPS is set to reduce local stocks’ allocation in its investment portfolio to 16.3 percent this year and 15.9 percent next year. Its share of local stocks in its portfolio is already 16.9 percent in March.

[ⓒ Maeil Business Newspaper & mk.co.kr, All rights reserved]

Copyright © 매일경제 & mk.co.kr. 무단 전재, 재배포 및 AI학습 이용 금지

- SsangYong files court approval to confirm KG-led consortium as final preferred bidder - Pulse by Maeil Business News Korea

- Korea’s Seegene develops fast-result diagnostic reagent for monkeypox virus - Pulse by Maeil Business News Korea

- 'Post-pandemic Day' edges near - Pulse by Maeil Business News Korea

- Explosive e-commerce growth drives demand for logistics - Pulse by Maeil Business News Korea

- Kakao ambiguous on sale rumor on Kakao Mobility amid employee protest - Pulse by Maeil Business News Korea

- 강경준, 상간남 피소…사랑꾼 이미지 타격 [MK픽] - 스타투데이

- AI가 실시간으로 가격도 바꾼다…아마존·우버 성공 뒤엔 ‘다이내믹 프라이싱’- 매경ECONOMY

- 서예지, 12월 29일 데뷔 11년 만에 첫 단독 팬미팅 개최 [공식] - MK스포츠

- 이찬원, 이태원 참사에 "노래 못해요" 했다가 봉변 당했다 - 스타투데이

- 양희은·양희경 자매, 오늘(4일) 모친상 - 스타투데이