Korean refiners to keep up hot earnings streak Q2 on soaring margin

![[Graphics by Song Ji-yoon]](https://img2.daumcdn.net/thumb/R658x0.q70/?fname=https://t1.daumcdn.net/news/202206/22/mk/20220622110319396josj.jpg)

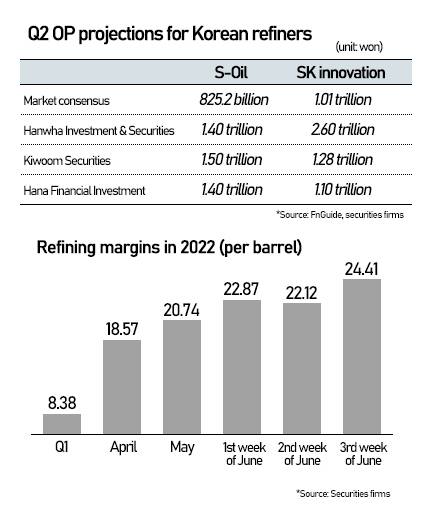

According to market tracker FnGuide on Tuesday, S-Oil is forecast to have earned 825.2 billion won ($638.10 million) in operating profit in the April-June period, which would be up 44.52 percent from the same period in the previous year. SK innovation’s operating income is projected to have been more than doubled to 1.01 trillion won over the same period.

Their profit margin has significantly improved, sending analysts to upgrade target stock prices on earnings surprise.

According to industry insiders, Singapore refining margins, the benchmark for profitability among oil processors in Asia, jumped to $8.38 per barrel in the first quarter of this year from $2.1 in the second quarter of last year. The index went further up to hit $20 milestone per barrel in May and $25 in June.

Refining margin is the difference between the prices of oil products and the feedstock like crude oil, measuring the value contribution of the refinery per unit of input. Industry insiders consider the margin of about $4 is a breakeven level for refiners. Upside is stronger for margins due to shortages of crude oils and petrol products from the Russia-Ukraine war and surging demand for aviation fuel and automobile gasoline during the holiday season after the economic reopening.

S-Oil’s operating profit in the second quarter would jump 12.6 percent on quarter to 1.5 trillion won, 81.8 percent higher above previous market consensus, projected Lee Dong-wook, a researcher at Kiwoom Securities.

Lee forecast S-Oil’s petrochemical business would swing to profit, posting 77.4 billion won, with the lube base oil section exceeding 200 billion won. Its refining business would have reaped 1.22 trillion won in operating profit, up 1.8 percent from the previous quarter.

![[Graphics by Song Ji-yoon]](https://img1.daumcdn.net/thumb/R658x0.q70/?fname=https://t1.daumcdn.net/news/202206/22/mk/20220622110319396josj.jpg)

Korean refiners would benefit most from the latest price boon.

“Given the various geopolitical situations including the relationship between the U.S. and Saudi Arabia, crude oil prices will likely stay high for the time being, which is favorable for Korean refiners,” said Jeon Woo-je, a researcher at Hanwha Investment & Securities. He raised the second-quarter operating income estimates for S-Oil and SK innovation from 1 trillion won to 1.4 trillion won and from 2 trillion won to 2.6 trillion won, respectively.

On the anticipation for strong earnings in the second quarter, local refinery stocks have fared better than other stocks in the bear market. S-Oil and SK innovation rose 3.30 percent and 4.27 percent, respectively, over the last month, outperforming the country’s benchmark Kospi index losing 8.73 percent. Goldman Sacks expected Brent Crude would go higher than $140 per barrel this summer.

[ⓒ Maeil Business Newspaper & mk.co.kr, All rights reserved]

Copyright © 매일경제 & mk.co.kr. 무단 전재, 재배포 및 AI학습 이용 금지

- POSCO chief in Australia to enhance partnership in EV battery materials biz - Pulse by Maeil Business News Korea

- Earnings surprises expected for Korean refiners in Q2 on strong refinery margins - Pulse by Maeil Business News Korea

- Korean carmakers brace for labor disputes over wage negotiations - Pulse by Maeil Business News Korea

- S. Korea’s space project gains traction for further exploration after Nuri 2 success - Pulse by Maeil Business News Korea

- June 1-20 trade data implies Korea in largest-ever 6-month deficit of over $15 bn - Pulse by Maeil Business News Korea

- 강경준, 상간남 피소…사랑꾼 이미지 타격 [MK픽] - 스타투데이

- AI가 실시간으로 가격도 바꾼다…아마존·우버 성공 뒤엔 ‘다이내믹 프라이싱’- 매경ECONOMY

- 서예지, 12월 29일 데뷔 11년 만에 첫 단독 팬미팅 개최 [공식] - MK스포츠

- 이찬원, 이태원 참사에 "노래 못해요" 했다가 봉변 당했다 - 스타투데이

- 양희은·양희경 자매, 오늘(4일) 모친상 - 스타투데이