Korea¡¯s bigger tax surplus to fuel political demand for extra budget

이 글자크기로 변경됩니다.

(예시) 가장 빠른 뉴스가 있고 다양한 정보, 쌍방향 소통이 숨쉬는 다음뉴스를 만나보세요. 다음뉴스는 국내외 주요이슈와 실시간 속보, 문화생활 및 다양한 분야의 뉴스를 입체적으로 전달하고 있습니다.

The Ministry of Economy and Finance on Thursday releases tax revenue in its monthly fiscal balance up to November on Thursday. Even without December income, the data will give a rough estimate of how much more tax revenue was collected last year.

After two revisions, tax revenue is expected to exceed government target one again.

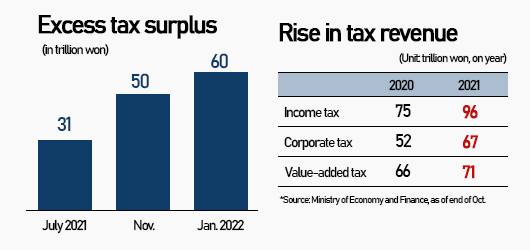

The government under political pressure in July raised the second supplementary budget by estimating 31.6 trillion won in excess of original estimate in annual budgeting. It packaged another relief funding for merchants by estimating 19 trillion won extra revenue in November

The surplus has been beating estimates due to surge in housing prices and taxes.

The extra revenue could heighten political pressure to raise supplementary budget before March. But since the year-end surplus would be reflected in other reserves after April, supplementary budget before then would have to be raised through debt issues. The three-year government bond broke above 2 percent while the 10-year government bond nears 2.5 percent amid oversupply concerns on top of jitters about faster and sharper tightening pace in the U.S.

Poor estimate in fiscal balance also undermines predictability and credibility in budgeting.

Kim Jung-sik, professor emeritus at Yonsei University, said that cooperation among ministries like National Tax Service and Ministry of Economy and Finance is essential in tax revenue estimation and that miscounting in figures show tax revenue calculation system isn¡¯t working right.

Lee In-ho, economics professor at Seoul National University, pointed out economic policy management is losing efficiency due to frequent changes in real estate policies.

[¨Ï Maeil Business Newspaper & mk.co.kr, All rights reserved]

Copyright © 매일경제 & mk.co.kr. 무단 전재, 재배포 및 AI학습 이용 금지

- Soft Berry raises Series A funding to bolster EV charger map, ready global foray - Pulse by Maeil Business News Korea

- Hyundai AutoEver under groom as software strength Hyundai Motor mobility - Pulse by Maeil Business News Korea

- LG Energy upon IPO to up economies of scale by expanding JV partners, capacity - Pulse by Maeil Business News Korea

- Hyundai Eng gains exclusive EPC rights for micro nuclear reactor projects of USNC - Pulse by Maeil Business News Korea

- Domestic insurance market expects double digit growth in 2022 - Pulse by Maeil Business News Korea

- 강경준, 상간남 피소…사랑꾼 이미지 타격 [MK픽] - 스타투데이

- ‘대치동 괴담’을 아시나요? [편집장 레터]

- “예비신부는 배다른 동생”...유재환, 피해자가 공개한 충격의 카톡 메시지 [MK★이슈] - MK스포

- 이찬원, 이태원 참사에 "노래 못해요" 했다가 봉변 당했다 - 스타투데이

- 양희은·양희경 자매, 오늘(4일) 모친상 - 스타투데이