Parallel luxury imports are big online as buyers seek bargains

전체 맥락을 이해하기 위해서는 본문 보기를 권장합니다.

"Luxury brands abroad are monitoring products that are not sold through official channels, worried about their brand value possibly falling," said an official working for a high-end brand. "The key is whether companies can supply a variety of items in sufficient quantities."

"There is potential for the market to grow and attract a wider group of customers if we get rid of concerns about fake products, secure sufficient stock of popular items and provide customer-friendly services," said a spokesperson for one of the online luxury shopping marketplaces. "Branching out to carry products of mid-tier luxury brands and contemporary designer brands is another area of opportunity."

이 글자크기로 변경됩니다.

(예시) 가장 빠른 뉴스가 있고 다양한 정보, 쌍방향 소통이 숨쉬는 다음뉴스를 만나보세요. 다음뉴스는 국내외 주요이슈와 실시간 속보, 문화생활 및 다양한 분야의 뉴스를 입체적으로 전달하고 있습니다.

![Actor Kim Hye-soo models for Balaan. [BALAAN]](https://img2.daumcdn.net/thumb/R658x0.q70/?fname=https://t1.daumcdn.net/news/202110/23/koreajoongangdaily/20211023070011697ukjl.jpg)

Luxury shopping is moving online, with start-ups leading the way.

According to market tracker Euromonitor, Korea’s overall luxury goods market was worth 15 trillion won ($12.7 billion) last year, down 0.1 percent on year. Luxury shopping done online was worth 1.6 trillion won. Although smaller than offline purchases, the figure rose 11 percent on year.

Luxury brands have their own online websites, but an increasing number of customers are choosing to shop at retailers that carry a variety of brands on one website for the sake of convenience and cost.

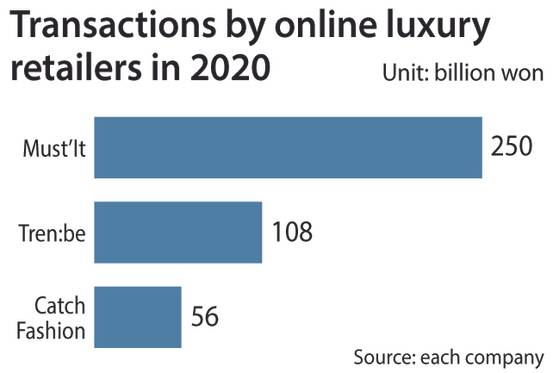

Transactions of 250 billion won were made on luxury goods platform Must’It in 2020, up 66 percent on year. Tren:be’s transactions were 108 billion won last year, up 139 percent. Catch Fashion’s were 56 billion won last year, up 115.4 percent.

Most of the items sold by these companies are brought into Korea by parallel importing, in which an importer without an authorized retail contract sells goods at cheaper prices by purchasing them through unauthorized channels. The items are mostly bought from boutiques abroad and are not counterfeit, but tend not to be under warranty and do not entitle the owner to customer support.

The companies earn profit by commissions, receiving fees of some 10 percent from the sellers abroad.

Although the main players in the market are small startups, the companies are growing fast by attracting investments from venture capital. Tren:be received 40 billion won of investment as of March, Catch Fashion took in 38 billion won of investment as of August, and Must’It 28 billion won as of May. Balaan secured a total of 10 billion won in investment as of last year, and announced Oct. 21 it had commitments for investments totaling 32.5 billion won. Companies such as Shinhan Capital, Naver, Company K Partners and Kolon Investment joined the round.

Easing concerns about the items possibly being counterfeit is expected to boost the market. Although parallel imports are not fake, some customers have preferred to give their money to authorized suppliers.

“Luxury brands abroad are monitoring products that are not sold through official channels, worried about their brand value possibly falling,” said an official working for a high-end brand. “The key is whether companies can supply a variety of items in sufficient quantities.”

Must’It and Tren:be have a policy in which they pay customers 200 percent of the price they paid if what they bought was found to be fake.

![An advertisement for Catch Fashion. [CATCH FASHION]](https://img1.daumcdn.net/thumb/R658x0.q70/?fname=https://t1.daumcdn.net/news/202110/23/koreajoongangdaily/20211023070014141oedk.jpg)

Companies are vying to attract new customers, and many have named celebrities as the faces of their brands. Balaan on Oct. 5 appointed actor Kim Hye-soo after a survey of 400 customers chose Kim as their favorite pick for brand ambassador. Actors Kim Hee-ae and Kim Woo-bin became the models of Tren:be in September, and Actor Zo In-sung for Catch Fashion and Ju Ji-hoon for Must’It.

Although young consumers are the majority of the customers for online shopping websites, the companies expect people in their 30s and 40s to follow.

“There is potential for the market to grow and attract a wider group of customers if we get rid of concerns about fake products, secure sufficient stock of popular items and provide customer-friendly services,” said a spokesperson for one of the online luxury shopping marketplaces. “Branching out to carry products of mid-tier luxury brands and contemporary designer brands is another area of opportunity.”

BY YOO JI-YOEN, LEE TAE-HEE [lee.taehee2@joongang.co.kr]

Copyright © 코리아중앙데일리. 무단전재 및 재배포 금지.

- After 512 episodes, Yumi and her cells say their final goodbye

- BTS to hold online concert 'BTS Permission to Dance on Stage' on Sunday

- Kim Seon-ho’s ex-girlfriend to take legal action against malicious comments

- Young people’s deaths after Pfizer vaccines are new worry

- Korean Air teams up with Boeing unit on unmanned vehicle

- CJ ENM could go for control of SM Entertainment

- Han So-hee says goodbye to pretty and hello to blood, sweat and tears

- Kim Joo-ryoung calls 'Squid Game' a reward for her dedication to acting

- 70% vaccination rate is almost there

- Blackpink’s Lisa joins forces with music producer DJ Snake