Global X's theme ETFs under Mirae Asset see assets double on strong performance

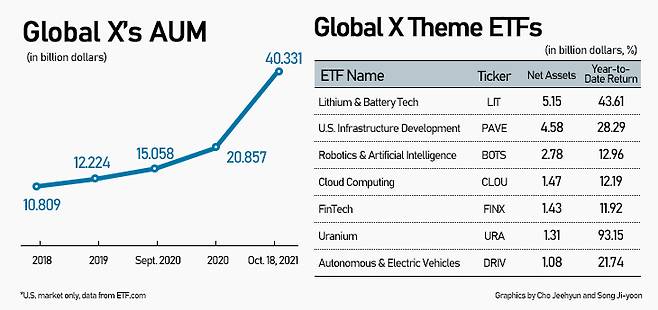

Assets under management by Global X reached $40.2 billion as of Oct 18, nearly doubled from $20.9 billion it had at the end of 2020, according to data from market tracker ETF.com.

New York-based Global X has gained impetus after it went under South Korean financial investment group Mirae Asset in January 2018.

The ETF specialist lately has been focusing its offering on themed products, which invest in companies or sectors expected to deliver long-term, structured growth. It has created theme ETFs in almost all areas in fashion, ranging from rechargeable battery and robotics to cloud computing and cyber security, amid international investors’ growing demand. According to Eugene Investment & Securities, theme ETFs listed in the U.S. has pulled in $32.3 billion from January to September this year to exceed last year’s inflow of $31.6 billion.

Other theme ETFs have been performing handsomely.

U.S. Infrastructure Development ETF has net assets of $4.58 billion and year-to-date return of 28.29 percent, which exceeds S&P 500’s 20 percent. The fund invests in infrastructure related sectors, from raw materials production to heavy equipment and construction that are expected to benefit from the U.S. government’s massive infrastructure investment plan.

Uranium ETF with net assets of $1.38 billion saws returns doubled from the beginning of the year, thanks to jump in global uranium price. Global X’s Uranium ETF is the largest among its kind in the world. The fund invests in companies involved in uranium mining and nuclear components production, which has come under global spotlight to resolve energy shortage issue created in the course of transition to renewable energy sources.

As of end of September, combined assets under management amounted to $74.2 billion at Global X’s ETFs and its Korean affiliate Mirae Asset Global Investments’s Tiger ETFs, according to market tracker ETFGI’s data.

[ⓒ Maeil Business Newspaper & mk.co.kr, All rights reserved]

Copyright © 매일경제 & mk.co.kr. 무단 전재, 재배포 및 AI학습 이용 금지

- Global X’s theme ETFs under Mirae Asset see assets double on strong performance - Pulse by Maeil Business News Korea

- SKT likely to carry out massive executive reshuffle ahead of non-telecom spinoff

- Samsung SDI to activate 1st US facility of 23GWh in JV with Stellantis 2025

- Naver, Kakao chiefs call for actions to address reverse discrimination vs foreign players

- Korea's biggest sale blowout planned for Nov as the country normalizes business hours

- 강경준, 상간남 피소…사랑꾼 이미지 타격 [MK픽] - 스타투데이

- AI가 실시간으로 가격도 바꾼다…아마존·우버 성공 뒤엔 ‘다이내믹 프라이싱’- 매경ECONOMY

- 서예지, 12월 29일 데뷔 11년 만에 첫 단독 팬미팅 개최 [공식] - MK스포츠

- 이찬원, 이태원 참사에 "노래 못해요" 했다가 봉변 당했다 - 스타투데이

- 양희은·양희경 자매, 오늘(4일) 모친상 - 스타투데이