Kakao Pay's delayed IPO to be priced at lowered band of $51-77

이 글자크기로 변경됩니다.

(예시) 가장 빠른 뉴스가 있고 다양한 정보, 쌍방향 소통이 숨쉬는 다음뉴스를 만나보세요. 다음뉴스는 국내외 주요이슈와 실시간 속보, 문화생활 및 다양한 분야의 뉴스를 입체적으로 전달하고 있습니다.

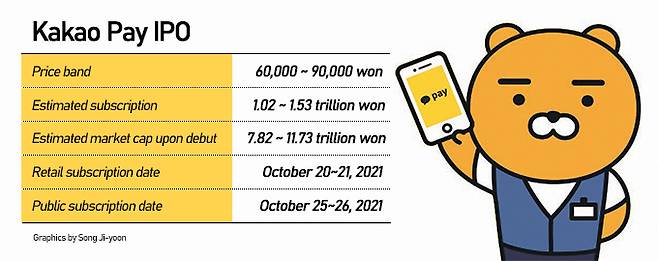

The simply pay platform on Wednesday embarked on a two-day bookbuilding session for 17 million at a desired pricing target range of 60,000 ($51) won to 90,000, which would fetch 1.53 trillion won ($1.3 billion) and place the market cap at 11.73 trillion won at the top end.

The stock bearing once-high-flying Kakao name may not debut in anticipated fanfare, given the latest icy response towards newcomers as well as negative sentiment and regulations on the omnipresent Kakao operators.

The company pushed back its IPO schedule twice amid toughened fintech regulations and overpricing controversy and shaved its IPO pricing band by 6.3 percent from original target.

Still many institutions find the IPO range still too pricy versus its modest net profit of 2.7 billion won in the first half.

Public subscriptions will take place on Oct. 25-26 and the new shares will debut on the main Kospi market on Nov.3.

Kakao Pay plans to apply uniform allotment for its entire IPO issue for the first time in the country’s IPO history to distribute the shares equally to all those who make the minimum subscription deposit to add appeal to retail investors.

Kakao Pay was launched in 2017 as a fintech spin-off from Kakao Corp. and has since expanded its business fast into insurance and securities. The company, 55 percent owned by Kakao and 45 percent by Ant Group’s Alipay Singapore Holding Pte Ltd., provides financial services including money transfers, savings accounts and asset management. It recorded a yearly transaction volume of 67 trillion won last year and 23 trillion won in the first three months of this year.

Shares of parent Kakao were 1.2 percent up at 129,000 won as of midday after going up to as high as 130.500 won.

[ⓒ Maeil Business Newspaper & mk.co.kr, All rights reserved]

Copyright © 매일경제 & mk.co.kr. 무단 전재, 재배포 및 AI학습 이용 금지

- Korean defense firms pitch aerospace, defense systems at ADEX 2021 - Pulse by Maeil Business News Korea

- Toss reforms wage and leave system to improve working environment - Pulse by Maeil Business News Korea

- Foreigners cherry-pick EV battery stocks while net-selling Korean stocks in Oct - Pulse by Maeil Business News Korea

- Kakao Pay’s delayed IPO to be priced at lowered band of $51-77 - Pulse by Maeil Business News Korea

- Ildong Bioscience seeks IPO for biz expansion into probiotics market - Pulse by Maeil Business News Korea

- 강경준, 상간남 피소…사랑꾼 이미지 타격 [MK픽] - 스타투데이

- ‘부자만 낸다’는 금투세, 개미는 왜 반대할까 [TOPIC]

- 대만 치어리더 한국스포츠 첫 진출…K리그 수원FC - MK스포츠

- 이찬원, 이태원 참사에 "노래 못해요" 했다가 봉변 당했다 - 스타투데이

- 양희은·양희경 자매, 오늘(4일) 모친상 - 스타투데이