Kakao shares fall 20 percent in a week as scrutiny increases

전체 맥락을 이해하기 위해서는 본문 보기를 권장합니다.

"Shares have already plunged reflecting the risks," said Huh Jae-hwan, an analyst from Eugene Investment & Securities. "However, more businesses can be hit with regulations ahead of the upcoming government audit season in October, and the presidential election next year."

Analyst Park Seok-hyun from KTB Investment & Securities warned that "investors should be careful with their investments until uncertainties related to regulations are resolved."

이 글자크기로 변경됩니다.

(예시) 가장 빠른 뉴스가 있고 다양한 정보, 쌍방향 소통이 숨쉬는 다음뉴스를 만나보세요. 다음뉴스는 국내외 주요이슈와 실시간 속보, 문화생활 및 다양한 분야의 뉴스를 입체적으로 전달하고 있습니다.

![Kakao founder Kim Beom-su, right, with the Ryan character created by Kakao Friends [KAKAO]](https://img1.daumcdn.net/thumb/R658x0.q70/?fname=https://t1.daumcdn.net/news/202109/13/koreajoongangdaily/20210913190124294uryt.jpg)

Kakao shares plunged by nearly 20 percent over the past week as it and its affiliates become the target of scrutiny by Korea's financial regulators.

The Fair Trade Commission has reportedly started investigating whether Kakao founder Kim Beom-su violated the Fair Trade Act by omitting information about Kakao's de facto holding company K Cube Holdings in regulatory filings.

Last week, lawmakers blamed big tech companies like Kakao and Naver for hurting small businesses with their market dominance and rapid business expansion, while the country's financial authorities said some services provided by fintech companies like Kakao Pay and Naver Financial violated the Financial Consumer Protection Act.

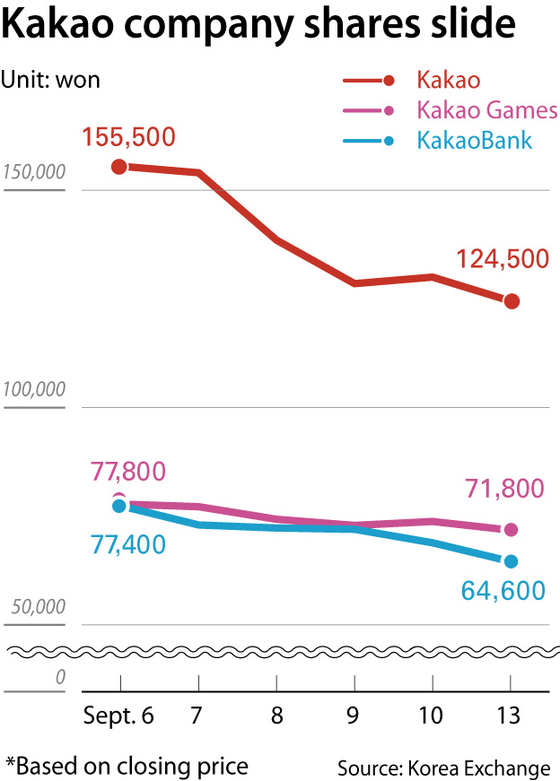

Affected by the regulatory risks, shares of Kakao and its affiliates continued to slide in the past week as foreign and institutional investors offloaded related shares. The market capitalization of the three listed Kakao companies — Kakao, KakaoBank and Kakao Games — shrank by roughly 18 percent, or 20 trillion won ($17 billion), on Monday compared to a week earlier.

On Monday, Kakao shares closed at 124,500 won, down 4.23 percent from the previous trading day. The price is a 20 percent plunge from 155,500 won at the beginning of last week.

Selling by foreign and institutional investors was especially severe on Wednesday last week, right after accusations were made by lawmakers and financial regulators on Tuesday. Institutional investors net sold 194 billion won of shares on a single day on Wednesday last week, while foreign investors net offloaded 433.6 billion won worth of shares.

Selling slowed on Monday, but it was not enough to stop prices from falling. Institutional investors net sold 40.3 billion won of Kakao shares while foreign investors were net buyers, taking 348.8 million won worth of shares.

Shares of KakaoBank tumbled 6.24 percent to close at 64,600 won and Kakao Games dropped 2.71 percent to close at 71,800 won.

As share prices continue to fall, Kakao shares have also become a major target for short sellers. Short selling is when an investor borrows stock and sells that stock immediately on the hope of buying it back at a lower price, repaying the loan and profiting from the difference.

According to data from the Korea Exchange, 259.4 billion won worth of Kakao's shares were sold short last week, which is some 9 times the 28.6 billion won sold short the previous week.

Analysts say that while additional weakening of Kakao shares is likely to be limited, a major concern is that this may just be the beginning of the government regulation drive.

"Shares have already plunged reflecting the risks," said Huh Jae-hwan, an analyst from Eugene Investment & Securities. "However, more businesses can be hit with regulations ahead of the upcoming government audit season in October, and the presidential election next year."

Huh added that while it is not likely the shares will continue to plummet, a relay of restrictions imposed by the government will make Korea's stock market unattractive for foreign investors compared to other markets with relatively less risk.

Analyst Park Seok-hyun from KTB Investment & Securities warned that "investors should be careful with their investments until uncertainties related to regulations are resolved."

BY KIM JEE-HEE [kim.jeehee@joongang.co.kr]

Copyright © 코리아중앙데일리. 무단전재 및 재배포 금지.

- Young people’s deaths after Pfizer vaccines are new worry

- CIO opens probe of presidential candidate Yoon

- Korea surpasses U.S., Japan in first vaccine doses

- Samsung thinks big and LG goes small as OLED market heats up

- North Korea tests new long-range missiles over weekend: KCNA

- Samsung settles on Taylor, Texas as site for new chip plant

- [NEWS IN FOCUS] Samsung Biologics expands contract development business

- Zoos take their wildlife from cages to online

- Lee twins careers now in the hands of the FIVB

- Dark secrets of Korea's 'moon castle' are unearthed