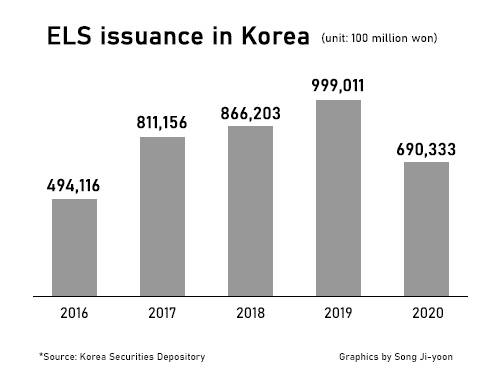

Korea's ELS issuance down 31% on year in 2020

The total ELS issuance came at 69 trillion won ($62.6 billion) in 2020, down 30.9 percent from the previous year. The total figure includes equity-linked bonds.

An ELS is a hybrid debt instrument designed to pay returns based on the performance of an underlying equity such as stock index and a basket of stocks.

The issuance of ELS products tracking stock indices outside Korea fell sharply. The products linked to S&P 500 shrank by 36.6 trillion won, Euro Stoxx 50 by 31.1 trillion won and Hong Kong’s HSCEI by 19.08 trillion won.

Issues of Kospi 200-linked products, however, rose 14.6 percent over the same period to 28.1 trillion won thanks to Korean stocks’ outperformance.

The largest ELS issuer was Mirae Asset Daewoo with 11.9 trillion won, followed by KB Securities with 8.3 trillion won and Korea Investment & Securities 6.9 trillion won. NH Investment & Securities issued 6.8 trillion won and Samsung Securities 6.8 trillion won.

The redemption in 2020 fell 23.0 percent on year to 78.5 trillion won. Early redemption was 51.8 trillion won, while 24.3 trillion won was collected upon reaching full maturity. Interim redemption was 2.3 trillion won.

As of end-December, the outstanding amount of ELS issues stood at 61.4 trillion won, down 13.6 percent from a year earlier.

[ⓒ Maeil Business Newspaper & mk.co.kr, All rights reserved]

Copyright © 매일경제 & mk.co.kr. 무단 전재, 재배포 및 AI학습 이용 금지

- Korea’s ELS issuance down 31% on year in 2020 - Pulse by Maeil Business News Korea

- Pharmicell makes impressive turnaround on Covid-19 test kit material - Pulse by Maeil Business News Korea

- S. Korea’s mid-tier game developers rush to roll out new titles - Pulse by Maeil Business News Korea

- Hyundai, Kia, each, ready $272 mn green bond offering in Feb - Pulse by Maeil Business News Korea

- Samsung Elec earns Common Criteria certification for 5G equipment - Pulse by Maeil Business News Korea

- 강경준, 상간남 피소…사랑꾼 이미지 타격 [MK픽] - 스타투데이

- AI가 실시간으로 가격도 바꾼다…아마존·우버 성공 뒤엔 ‘다이내믹 프라이싱’- 매경ECONOMY

- 서예지, 12월 29일 데뷔 11년 만에 첫 단독 팬미팅 개최 [공식] - MK스포츠

- 이찬원, 이태원 참사에 "노래 못해요" 했다가 봉변 당했다 - 스타투데이

- 양희은·양희경 자매, 오늘(4일) 모친상 - 스타투데이