Samsung heir's jail sentence disrupts management succession plans

이 글자크기로 변경됩니다.

(예시) 가장 빠른 뉴스가 있고 다양한 정보, 쌍방향 소통이 숨쉬는 다음뉴스를 만나보세요. 다음뉴스는 국내외 주요이슈와 실시간 속보, 문화생활 및 다양한 분야의 뉴스를 입체적으로 전달하고 있습니다.

![[Graphics by Song Ji-yoon]](https://img1.daumcdn.net/thumb/R658x0.q70/?fname=https://t1.daumcdn.net/news/202101/19/mk/20210119105414612gnox.jpg)

Lee, 52, would be returning to jail after serving roughly a year behind bars in 2017-2018 for bribing a confidante of Korea’s impeached president Park Geun-hye. He was released on a suspended prison term in 2018. The Monday verdict from the Seoul High Court is the result of a retrial ordered by the Supreme Court. His prior prison time would count toward his new sentence, meaning Lee could walk free next year if granted early parole.

Lee, who currently serves as Samsung Electronics Co.’s vice chairman, was slated to become the new chairman following the death of his father, Lee Kun-hee, in October 2020. His appointment, along with the announcement of ownership restructuring plans, had been scheduled for March during Samsung Electronics’ annual shareholder meeting. But the latest sentence is likely to delay the plans by at least a year and a half.

![[Photo by Lee Chung-woo]](https://img3.daumcdn.net/thumb/R658x0.q70/?fname=https://t1.daumcdn.net/news/202101/19/mk/20210119105420468mxol.jpg)

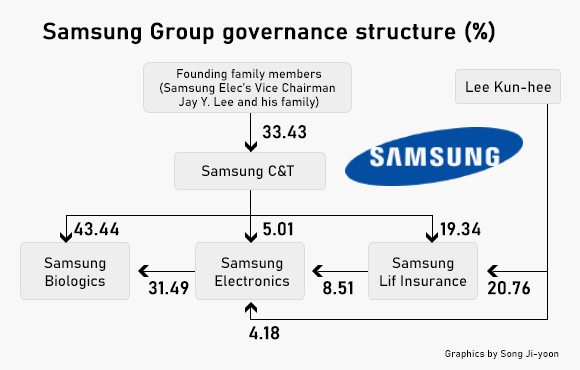

The latest verdict is likely to forestall the conglomerate’s plans to reorganize ownership around the de-facto holding company Samsung C&T and the crown jewel Samsung Electronics. As of early January, the owner family and affiliates control Samsung C&T with a combined 33.43 percent stake, with Lee holding 17.33 percent and the late chairman holding 2.88 percent.

Samsung C&T has major stakes in Samsung Life Insurance (19.34 percent), Samsung Electronics (5.01 percent) and Samsung Biologics (43.44 percent). Samsung Life Insurance has an 8.51 percent interest in Samsung Electronics, which in turn owns 31.49 percent in Samsung Biologics.

For Lee to consolidate his grip over the empire, Samsung Life’s stake in Samsung Electronics needs to come under Samsung C&T and the owner family.

Industry observers say Samsung C&T does not have the tens of billions of dollars needed to acquire all of Samsung Life’s stake in Samsung Electronics.

Various financing ideas have been floated. One scenario sees Samsung C&T selling its stake in Samsung Biologics to buy Samsung Electronics stake. Another suggests Samsung Electronics could be demerged into investment and operation units, with the investment unit acquiring Samsung Electronics’ operation unit stake owned by Samsung Life and Samsung C&T acquiring the investment unit.

Lee also needs to foot an inheritance tax bill of nearly $10 billion if he is to acquire his late father’s stakes in Samsung subsidiaries.

[ⓒ Maeil Business Newspaper & mk.co.kr, All rights reserved]

Copyright © 매일경제 & mk.co.kr. 무단 전재, 재배포 및 AI학습 이용 금지

- Fubon Hyundai Life plans $551 mn capital expansion ahead of new accounting rule - Pulse by Maeil Business News Korea

- Google, Facebook, Neflix must ensure network and service stability in Korea - Pulse by Maeil Business News Korea

- Samsung heir Lee returns to prison upon sentenced 2 and 1/2 years jail term - Pulse by Maeil Business News Korea

- JW Bioscience invests in Singapore’s molecular diagnostic firm One BioMed - Pulse by Maeil Business News Korea

- Hyundai Nexo hydrogen SUV in safety, spec upgrade and cheaper price tag - Pulse by Maeil Business News Korea

- 강경준, 상간남 피소…사랑꾼 이미지 타격 [MK픽] - 스타투데이

- 금융당국이 손보려는 농협중앙회...NH농협금융 지배구조 ‘복마전’ 왜?

- 대만 치어리더 한국스포츠 첫 진출…K리그 수원FC - MK스포츠

- 이찬원, 이태원 참사에 "노래 못해요" 했다가 봉변 당했다 - 스타투데이

- 양희은·양희경 자매, 오늘(4일) 모친상 - 스타투데이