S. Korea's household debt soars while sovereign debt is in relatively good shape

이 글자크기로 변경됩니다.

(예시) 가장 빠른 뉴스가 있고 다양한 정보, 쌍방향 소통이 숨쉬는 다음뉴스를 만나보세요. 다음뉴스는 국내외 주요이슈와 실시간 속보, 문화생활 및 다양한 분야의 뉴스를 입체적으로 전달하고 있습니다.

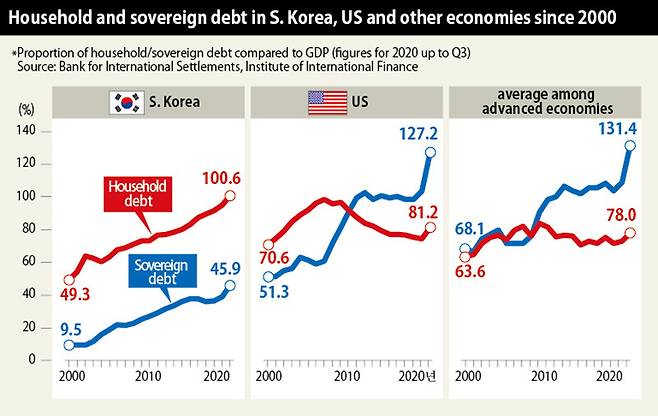

South Korea’s sovereign debt is still in good shape, but household debt in the country has reached a serious level, the latest statistics show. That stands in contrast with major economies, including the US, the UK, and Japan, in which sovereign debt is in a worse situation than household debt. The implication is that more government spending is needed to help the country navigate the COVID-19 crisis.

According to statistics about sovereign debt and household debt in major countries compiled by the Institute of International Finance (IIF) last month, South Korea’s sovereign debt amounted to 45.9% of gross domestic product (GDP) in Q3 2020. That’s considerably lower than the 131.4% average among rich economies, and even the 104.8% average across the 50 countries compared by the IIF.

Most major countries had sovereign debt in excess of 100% of GDP, including the US (127.2%), the UK (130.1%) and Japan (257.2%). Levels were lower in emerging economies such as China (63%), India (80.2%), and Brazil (93.1%).

But a different trend is evident in household debt. Korea’s household debt rose to 100.6% of GDP in Q3 2020, the first time it topped 100%. That’s a very high level compared to leading countries. Household debt in the US in the same quarter stood at 81.2%, while the average was 78% in wealthy countries and 65.3% across all 50 countries being compared.

The IIF is regarded as an authority on analyzing international financial markets. Founded in the early 1980s in order to respond to an international debt crisis, the IIF’s members include financial institutions in more than 70 countries.

Sovereign debt in South Korea and other major countries has risen considerably as they tried to mitigate the pandemic, with governments issuing large volumes of bonds to raise money for their programs.

But South Korea’s sovereign debt hasn’t risen as much as other countries. At the end of 2019, shortly before the novel coronavirus began to spread, debt stood at 41.6% of GDP. By Q3 2020, it had gone up about 4.3 points, to 45.9%.

During the same period, the US increased its sovereign debt by 25.3 points, the UK by 24.4 points and Japan by 27.4 points. The average increase in wealthy countries was 21 points, and the average in the total panel of 50 countries was 15.9 points. Even in China, which is categorized as an emerging economy, sovereign debt rose by 9.3 points.

Experts argue that, in such a crisis, the government ought to be more proactive and has failed to meet expectations.

“In the medium to long term, the government needs to ease the burden on households and companies by increasing government spending to an extent that doesn’t harm fiscal health,” said Jang Min, a senior analyst with the Korea Institute of Finance.

By Park Hyun, staff reporter

Please direct comments or questions to [english@hani.co.kr]

Copyright © 한겨레. 무단전재 및 재배포 금지.

- 제주 카지노서 사라진 145억원 중 81억원 금고에서 발견

- ‘집합금지’ 어기고 5명 식사모임 가진 여자 프로배구 선수들

- 이만희 신천지 총회장 ‘코로나 방역 방해’ 무죄…횡령은 인정

- 앉아 일하는 당신, 하루 11분 운동도 좋다…하루 35분이 어렵다면

- 15일 오전 6시부터 연말정산 간소화 서비스 시작

- ‘꽃미남’ 정승원, “저 터프해서 남성팬들도 많아요!”

- 상하목장 우유, 소비자들 ‘빨대 어택’에 응답했다

- [뉴스AS] 옥시는 유죄, SK케미칼·애경·이마트는 무죄…왜?

- 휴양지 같은 욕실, 주방일 도와주는 로봇…CES에서 소개된 신박한 가전은?

- 북한의 ‘자력갱생’ 노선은 언제부터 시작된 것일까요?