Kolon LS shares plunge after ICC ruling in compensation case

이 글자크기로 변경됩니다.

(예시) 가장 빠른 뉴스가 있고 다양한 정보, 쌍방향 소통이 숨쉬는 다음뉴스를 만나보세요. 다음뉴스는 국내외 주요이슈와 실시간 속보, 문화생활 및 다양한 분야의 뉴스를 입체적으로 전달하고 있습니다.

The company’s stock price lost 5.13 percent 26,800 won ($24.36) as of 11:00 am after an 8 percent drop at the opening bell.

The ICC panel ruled that Kolon Life Science should pay Mitsubishi Tanabe Pharma about 43 billion won including upfront payment, damages, accrued interest, and lawsuit costs, according to a regulatory filing released by Kolon Life Science on Tuesday.

Mitsubishi Tanabe Pharma filed a suit at the ICC in April 2018, claiming its 25 billion won upfront payment should be returned on contract cancellation caused by the fault of Kolon Life Science.

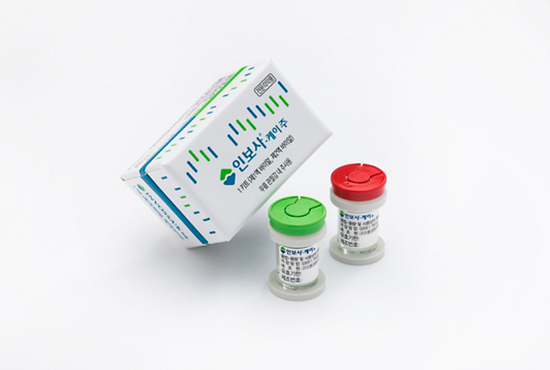

The two signed a 500 billion won license deal in 2016 over Kolon’s osteoarthritis drug Invossa to be sold across Japan, but Mitsubishi Tanabe scrapped the deal in late 2017 after Kolon Life Science announced an ingredient mix-up in the gene therapy.

The ICC also said a clinical hold letter from the US Food and Drug Administration (FDA) was not provided in a timely manner to Mitsubishi Tanabe during their license agreement. Mitsubishi Tanabe recognized that Invossa developer Kolon TissueGene had received the letter only a year after the license contract was signed.

Kolon TissueGene received the letter in May 2015 and suspended its Phase 3 trial in the U.S., but this was disclosed only in December 2017, one month after its IPO in Korea. The CHL was lifted in July 2018.

[ⓒ Maeil Business Newspaper & mk.co.kr, All rights reserved]

Copyright © 매일경제 & mk.co.kr. 무단 전재, 재배포 및 AI학습 이용 금지

- 11Street, Shinsegae partner to broaden early-morning delivery, diversify items - Pulse by Maeil Business News Korea

- Samsung lays out AI and robotic assistance from everyday chores to workout - Pulse by Maeil Business News Korea

- Doosan Infracore’s 2020 excavator sales in China hit 10-year high - Pulse by Maeil Business News Korea

- Korea’s controversial AI chatbot Luda to be shut down temporarily - Pulse by Maeil Business News Korea

- S. Korea to remove short-sale ban as planned in March - Pulse by Maeil Business News Korea

- 강경준, 상간남 피소…사랑꾼 이미지 타격 [MK픽] - 스타투데이

- LS그룹이 전격 철회한 RSU 뭐길래 [BUSINESS]

- ‘음주 운전’ 김새론, 연극 ‘동치미’ 하차...연기 복귀 노렸지만 ‘부정적 여론’에 무산 - MK

- 이찬원, 이태원 참사에 "노래 못해요" 했다가 봉변 당했다 - 스타투데이

- 양희은·양희경 자매, 오늘(4일) 모친상 - 스타투데이