S. Korea to remove short-sale ban as planned in March

![[Photo by Han Joo-hyung]](https://img2.daumcdn.net/thumb/R658x0.q70/?fname=https://t1.daumcdn.net/news/202101/12/mk/20210112103003372sabu.jpg)

The Financial Services Commission on Monday issued a rare text press statement on Monday, reiterating that amendments to short-sale regulations were being finalized to re-allow the trade from March as planned.

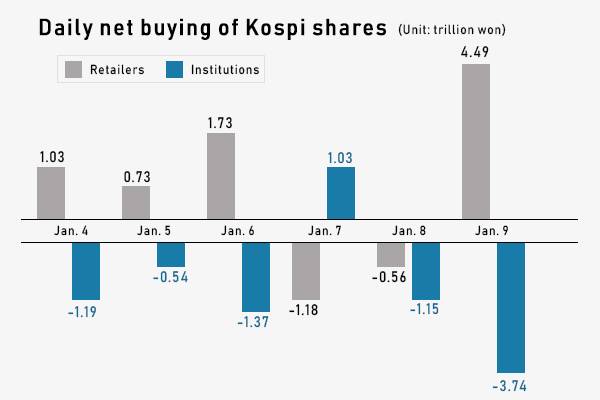

Some ruling party lawmakers have been petitioning for another extension as short-sale ban from March had been viewed a key motivator for unfazed retail buying.

Retailers, the primary force behind the Kospi’s stunning performance – the best so far this year among key markets - have been calling for another extension in the initial six-month ban, as a market crash would bode badly for the ruling front in April by-elections to elect mayors for the country’s two most important metropolitans Seoul and Busan.

Authorities banned short-selling, a bet on price fall, done mostly by foreign institutions on March 13 when Kospi crashed to 1,771.44 and Kosdaq to 524 amid frantic foreign selloff. The ban was extended for another six months in September and goes off on March 15.

The financial regulator sees little justification to continue the current ban as the local stock market has been reaching new heights. The main Kospi has remained above the 3,000 threshold after closing above the mark for the first time on Thursday.

The financial regulator will improve market transparency by establishing additional safety net by the time the cap is removed. Measures include enhancing monitoring and penalty over illicit short selling activities.

The regulator has already come up with a new rule of imposing criminal punishment of one year or more imprisonment plus a fine on naked short selling from April. Covered short selling activities – or buying back borrowed shares to close out an existing short position – will also be under close monitoring.

The regulator also plans to lower the bar and invite more retail investors to take part in short selling activities given currently they are mostly carried out by foreign and institutional investors.

The lift will likely spook retailers and splash cold waters. Bio and healthcare shares would be most volatile, analysts noted.

Noh Dong-gil, an analyst at NH Investment Securities, said that healthcare stocks gained ground in the Kosdaq market last year after short selling activities were banned.

“Given the large share taken up by bio and healthcare shares in the Kosdaq market, the lift in the short selling ban would be an important inflection point on stock prices,” he said.

Analysts expected the stock price of top market caps to be less affected by short selling resumption.

[ⓒ Maeil Business Newspaper & mk.co.kr, All rights reserved]

Copyright © 매일경제 & mk.co.kr. 무단 전재, 재배포 및 AI학습 이용 금지

- Korean financial regulator finds Kospi overheated if it hits 3300 - Pulse by Maeil Business News Korea

- Celltrion’s Covid-19 cure, AstraZeneca’s vaccine under emergency use review in Korea - Pulse by Maeil Business News Korea

- Samsung, LG to highlight pioneering screen tech at virtual CES 2021 - Pulse by Maeil Business News Korea

- Seoul shells out record high of $11 bn in unemployment benefit in 2020 - Pulse by Maeil Business News Korea

- BTS to open Samsung Galaxy S21 online unpacking Thursday - Pulse by Maeil Business News Korea

- 강경준, 상간남 피소…사랑꾼 이미지 타격 [MK픽] - 스타투데이

- AI가 실시간으로 가격도 바꾼다…아마존·우버 성공 뒤엔 ‘다이내믹 프라이싱’- 매경ECONOMY

- 서예지, 12월 29일 데뷔 11년 만에 첫 단독 팬미팅 개최 [공식] - MK스포츠

- 이찬원, 이태원 참사에 "노래 못해요" 했다가 봉변 당했다 - 스타투데이

- 양희은·양희경 자매, 오늘(4일) 모친상 - 스타투데이